Jane and I send you Love and Light from our new home near downtown Winston-Salem in North Carolina. Since our last newsletter in February, the world has been transformed by the coronavirus pandemic and the 2020 Global Financial Meltdown, version 2.0.

Yesterday March 24, 2020 we had a New Moon in Aries in tight conjunction with Chiron, the Wounded Healer of the Zodiac. Needless to say as a society and as individuals we are feeling wounded, struggling for healing, and trying to grope our way forward in a situation where it is difficult to see what lies ahead with any degree of clarity, as would be the case on any forest trail on a dark moonless New Moon night.

Chiron says we will find our way forward by going deep into the pain. In that pain we will find true healing. In feeling our own pain we become sensitized to the pain of others, and our hearts open in compassion for suffering humanity. It is only by working together that we can find healing in a world beset by the coronavirus pandemic. That is our task this New Moon week.

on a typical self-isolation day

Jane and I have been in Winston-Salem for about 10 days and during that time we have received a number of emails from customers who want to know when the store will reopen.

On our website, we promised we would give you a re-opening date sometime in March, and we do understand that in this time of global crisis, when it may be hard to go shopping for crystals at neighborhood stores, people are counting on Satya Center to provide them with healing stones and gemstone and crystal allies.

Believe me you should never ever move your home and online store simultaneously during a pandemic.

This is going to take a few weeks longer than we expected because we have not been able to use any helpers — social distancing — and we have had to disinfect everything the movers touched while packing.

Lila helps unpack in Jane's new kitchen

We are currently still living in towers of boxes, and have to clear away a lot before we can unpack our online inventory. It's stressful for us, but Lila is in feline nirvana! She loves nothing more than diving into huge boxes full of discarded wrapping paper, then jumping up and out to race across the room and explore a different tower of boxes which provide her with a commanding view of our new condo. Or else she just lounges on unpacked parcels anywhere and everywhere. She disinfects herself with regular self-bathing.

Early 1700s Barn in Moravian section of Old Salem in our neighborhood

We finally were able to buy some toilet paper for the first time since we got to Winston, about ten days ago, so that's very helpful. We are using Everclear mixed with vinegar and lavender essential oil instead of rubbing alcohol to disinfect things, because there is none available, and of course no sanitary wipes at all.

As we unpack, we are also in the middle of a total upgrade and redesign of the Satya Center website, which we started just prior to moving, so we are working day and night. As you can see we do have our computers and Internet running again, and we will be sending out a Full Moon newsletter next week.

Redbud on the Old Salem Strollway near our condo

The current timeline for the store re-opening is late April. Whether or not the new website is complete by then, we plan to reopen the store. We will send another newsletter a week or so ahead of the re-opening to announce the date and it will also appear on our website at that time.

We appreciate your patience in this global emergency.

Strollway from Old Salem into Downtown Winston-Salem near our condo

We appreciate all your kind words and thoughts, love and light, and we will do our best to transform that energy into the work required to reopen as rapidly as possible.

White Swan Pandemic Triggers Global Financial Meltdown 2.0

The whole world is experiencing a viral Pan-demic, there is Pan-ic in global financial markets, and Pan-demonium has been unleashed in peoples' lives since the Capricorn stellium appeared this January to usher in the new decade. Sun, Jupiter, Saturn, Pluto and Mercury all conjoined in the sign of the seagoat, a sign often associated with the great God Pan!

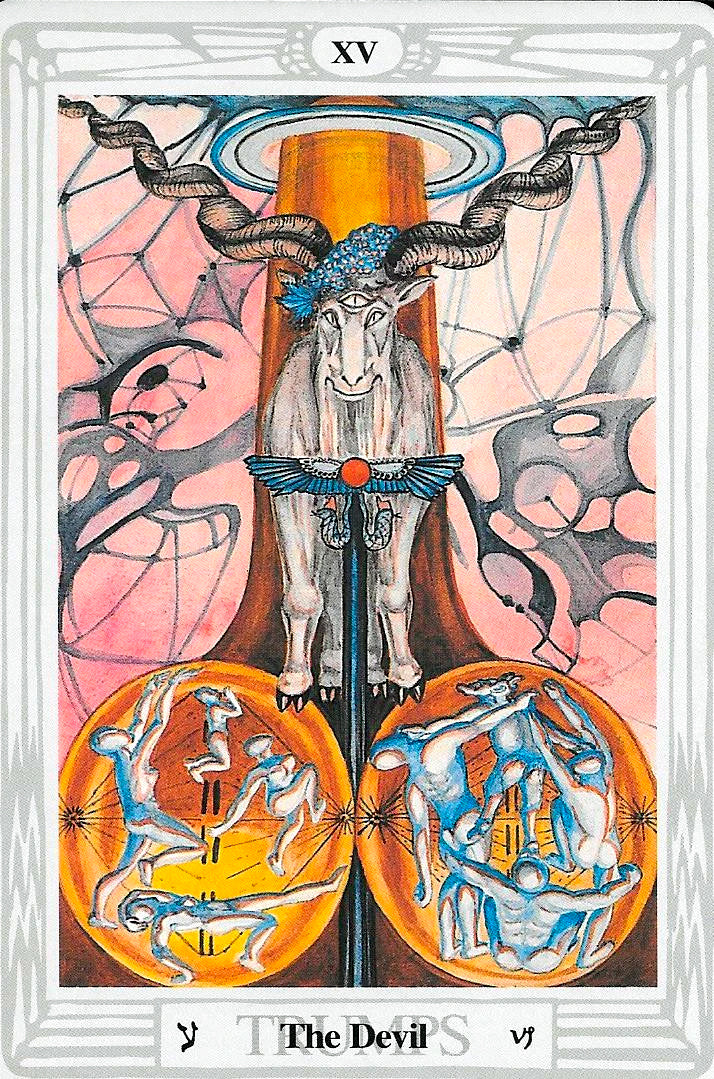

In the Thoth Tarot deck, Trump XV depicting Pan is called The Devil, and is often associated with excessive attachment to material reality, to wealth, to sexual pleasure, and to family and social networks, leading to various kinds of suffering. On the positive side, the phallic symbolism of the image indicates that the energy of the Great God Pan is essential to procreation and to the maintenance of a healthy libido, a healthy psyche and a healthy ecosystem. All in moderation, but with Pan's appearance, balance may be extremely hard to maintain!

In our January Cosmic Weather Forecast we predicted that the beginning of this year could mark the peak of a global financial mania, a rolling top to the overheated Trump era stock market, the kind of materialistic excess identified with the negative manifestation of Pan.

The unrelenting upward movement of the American stock market over the last decade was unleashed by a tsunami of free money in the form of cheap credit distributed by central banks to financial firms worldwide in the wake of the 2008 Global Financial Crisis. The first Global Financial Crisis was triggered by the collapse of the market for Collateralized Mortgage Obligations, a subset of the vast global derivatives market, along with the meltdown of American residential real estate values. The real estate bubble that burst in 2008 had been fueled by low interest rates mandated by the Federal Reserve after the 2001 dot.com bubble burst, threatening to collapse the American stock market and trigger a depression.

It was in 2008, of course, that Pluto entered Capricorn and began a series of hard outer planet aspects culminating in the Grand Cardinal Cross and the Uranus-Pluto squares that dominated the celestial climate in the 2010s.

The Fed resolved to lower interest rates again in 2008 in hopes of inflating new investment bubbles. In addition, the Federal government bailed out big banks and Wall Street firms threatened with bankruptcy.

In the years following the 2008 Global Financial Meltdown, too big to fail banks and Wall Street investment firms used trillions of dollars of taxpayer money to place high risk bets in the opaque derivatives market, the same market that brought us the overpriced, unsafe Collateralized Mortgage Obligations and other derivatives that imploded and created the real estate crash precipitating the 2008 financial crisis.

Speculators, banks, Wall Street firms and everyday investors found that low or previously unheard of negative interest rates reduced the yield on traditional, safe investments such as government bonds to the point that they were willing to take on financial risk they would previously have avoided.

Money poured into stocks, junk bonds, fracking partnerships and commercial real estate investment trusts.

The infusion of cash from central banks worldwide inflated even bigger bubbles in every type of investment vehicle known to man. Even government bonds, which usually provide a safe predictable amount of interest for savers and retirees, became speculative investments. Bond yields from interest were at historical lows, but interest rates were increasingly depressed by central banks, often entering negative territory. The more interest rates fell, the more valuable older bonds with higher interest rates became, so all bonds became instruments of wild speculation worldwide. Any bond you bought on a given day would appreciate in value as long as interest rates kept falling. And they did.

Big investors, banks and Wall Street firms and corporate America experienced unprecedented profits during the 2010s -- a decade of easy money promoted by central bankers. Financiers who caused the crash of 2008 were rewarded while ordinary Americans suffered foreclosures, layoffs, cutbacks in government safety nets, and generalized austerity.

Cheap money allowed large corporations to turbocharge the financial mania. Apple, Boeing and the rest of the S&P 500 borrowed trillions of dollars worth of money at absurdly low interest rates and used that free money to buy back their own stock, inflating their stock prices, and attracting yet more investment from yield-starved investors.

From the 1930s until 1982 stock buybacks were treated as illegal stock manipulation. During the reign of Ronald Reagan, the Securities and Exchange Commission passed rule 10b-18, which legalized stock buybacks and opened the door to the speculative excesses that would contribute greatly to the 2020 Global Financial Crisis.

For example: "In the 2000s Boeing was a superb aircraft maker," explains London Banker Bill Blain in a March 24 blogpost. "Their new B-787 Dreamliner was superb, and efficient with composite materials saving fuel and making for a better flight. The company had struggled to finance its development – but had borne the cost because the revenues from the successful B-747 Jumbo programme were drawing to a close. The company was making money from its venerable B-737 regional jet programme. Despite 9/11 and the 2008 crash, the aviation market was expanding. What did the company do next?"

"As interest rates tumbled to near zero, did it borrow money to finance the development of a modern replacement to the 50 year old B-737?" Blain asks. "Nope. It borrowed lots of money from the bond market. It then spent $43 billion, including all the profits from the B-737 sales, to buy back its own stock. The result was a soaring stock price – which meant the management got bigger bonuses. Much bigger bonuses. They didn’t develop a new plane, but modernised the old one and scrimped on safety. The B-737 Max was an unsafe disaster, killing 346 passengers in avoidable crashes. It remains grounded."

"Boeing is asking for a state bailout."

Corporations like Boeing and Apple became addicted to stock share buybacks. In effect America's largest corporations came to depend on state subsidized loans to send their stock prices into the stratosphere.

This was a textbook case of corporate socialism. The financial meltdown caused by imprudent investments in collateralized mortgage obligations, a flavor of financial derivatives, resulted in massive losses that were socialized and paid for by taxpayers, but the profits that accrued from the taxpayer bailouts were privatized and delivered almost exclusively to the top 1% of the population, resulting in unprecedented inequality. Not a single financier was prosecuted and jailed for malfeasance or fraud, despite the fact that thousands of mortgages were sold to individuals who clearly could not pay them back, and despite a lack of proper paperwork that should have rendered many of these mortgages invalid.

In post-bailout America, skyrocketing inequality resulted in unprecedented anger among the 99% of Americans living in an austerity regime so the 1% could become ever more wealthy. That anger led directly to the formation of the Occupy movement, the Tea Party movement, and the rise of Donald Trump and Bernie Sanders.

A combination for the pictures of October 2011 global protests, the place where the pictures have been taken from left to right and above to below: London, UK - São Paulo, Brazil - Wall street, New York City, USA - Montreal, Canada - Zürich, Switzerland - Frankfurt, Germany.

Authors of the files (by the same order of the files): Roland zh، Lutz، Crispin Semmens، Justinform، Biella & Gabriella; Coleman، David Shankbone. (Combined by Abbad). / CC BY-SA (https://creativecommons.org/licenses/by-sa/3.0)

Authorities had hoped the financial system would be healed by President Obama's Wall Street bailout and the Fed's easy money regime. Over $14 trillion was dispensed to troubled banks and financial firms, but the residential real estate market was not bailed out. Individuals with onerous mortgages, some manifestly fraudulent, endured foreclosure and financial ruin. One relatively small bubble in the Titanic global derivatives market was replaced by many larger financial bubbles, in stocks, bonds, corporate debt, commercial real estate, and fracking partnerships, and the system became more and more fragile as social and political divisions widened and hardened.

Large corporations became dependent upon financial manipulation and began to ignore basic research and development and cut back on customer service and product quality. On every level the economy and the financial system became more and more fragile, more and more completely designed to deliver risk-free returns to investors, bankers and large corporations.

This long building systemic risk would ultimately result in another financial meltdown, in March 2020, when the coronavirus epidemic shattered the global supply chain and necessitated the closure of vast swathes of the global economy. A meltdown that would require an even larger bailout. America's 1% once again expect taxpayers to foot the bill.

Our January newsletter discussed this mounting financial fragility, and we noted that the Capricorn stellium indicated that the bull market had probably reached its peak, while new, unknown risks were emerging that could cause even greater financial problems than ever before.

We said, "The Saturn/Pluto conjunction in Capricorn suggests that the globalized system of increasingly unregulated transnational digitized financial flows has now colonized every aspect of human life and culture. Financiers have created increasingly sophisticated algorithmic derivative financial products. These derivatives assign monetary value to virtual slices of reality representing perceived price at an infinite number of points in future time, all discoverable and tradable in a timeless digitized present. Unfortunately these derivatives are opaque to public view and prone to periodic meltdown and collapse in value, as we saw in the 2008 Financial Crisis. This [January] may be the high point of this global financial regime as a historical force."

"This globalized neo-liberal Utopian laissez-faire dispensation, which was initiated in the regimes of Ronald Reagan and Margaret Thatcher was empowered by advances in computerization, computer networking, software development and social engineering. The new regime empowered the financial sector, technology oligopolies and transnational corporate entities at the expense of the rest of society. This neoliberal nirvana may have reached a climax of sorts, here in 2020, an apotheosis of command and control that has crystallized societies around the world into highly inequitable groupings of super-rich plutocrats on the one hand and all the rest of humanity on the other hand."

"This social formation seems all powerful but may, like the Catholic Church in the 16th century, be at a point of unexpected fragility, as revealed in the 2008 financial crisis. Although financial markets in the US are booming at present, structural defects such as runaway credit booms, trade wars, currency conflicts, unsustainable deficits and negative bond yields point to the potential for dramatic systemic challenges ahead."

The coronavirus epidemic was simply the white swan event, the unexpected chaotic element, that crystallized the collapse of a system that was doomed to failure by its own internal contradictions.

Sempro95 / CC BY (https://creativecommons.org/licenses/by/4.0)

Never before in the history of industrialized civilization has the entire global economy been so interconnected, and never before has it been suddenly stopped dead in its tracks. The coronavirus pandemic represents not just a white swan event, but a worst case white swan event that no economist, politician or prognosticator had modeled or envisioned.

Entire sectors of the economy have been shut down to enforce quarantines and isolate healthy people from infection. The global supply chain has been disrupted. Vital medical supplies, drugs, electronic gadgets, clothes, toilet paper, sanitary wipes and many other types of retail goods manufactured in China, the epicenter of the pandemic, are no longer available globally. Global trade is collapsing as nations close their borders. Travel for business or pleasure has come to a halt. This is the new normal in March 2020.

Because this pandemic is caused by a new virus, there is no effective treatment and no vaccine. Only widespread testing, quarantine of the infected, and self-isolation by the general population seems to work to stop the spread of the virus. That means that a lag time of about a year or two will be required to bring the virus under control. So there is no doubt that the March 2020 Global Financial Meltdown will not suddenly reverse itself. We will have more to say about the coronavirus in a later newsletter, but for now let's concentrate on the financial and economic catastrophe we are experiencing.

This March could be the Chernobyl of financial crises -- a life changing once in a lifetime event. The current financial meltdown dwarfs the 2008 Global Financial Crisis and even the Great Depression following the 1929 Stock Market Crash in both intensity and speed of development.

Sign at Entrance to Chernobyl Exclusion Zone - Northern Ukraine

Adam Jones from Kelowna, BC, Canada / CC BY-SA

(https://creativecommons.org/licenses/by-sa/2.0)

In those two previous financial crises stock markets lost 50% or more of their value, GDP contracted by 10% or more, unemployment rates soared above 10%, and credit markets froze, but it took three years for all these disasters to fully unfold.

This March, US stock markets declined 35% into bear market territory in just three weeks! Credit markets are frozen, and big borrowers like Boeing, hotels, cruise lines, petroleum companies engaged in fracking, and thousands of other large companies are forced to pay nose bleed premiums for new cash, if any is available to them at all. Junk bonds have collapsed in value and commercial real estate trusts are on the verge of implosion.

"Even mainstream financial firms such as Goldman Sachs, JP Morgan and Morgan Stanley expect US GDP to fall by an annualized rate of 6% in the first quarter, and by 24% to 30% in the second. US Treasury Secretary Steve Mnuchin has warned that the unemployment rate could skyrocket to above 20% (twice the peak level during the Global Financial Crisis)," explains New York University economist Dr. Nouriel Roubini, known on Wall Street as Dr. Doom because he predicted the Global Financial Crisis and its cause prior to the event.

Within the next six months, we will have experienced greater financial and economic catastrophe than was endured by the equivalent of three years of the Great Depression, if these mainstream economic forecasts are correct.

This is the end of an era. Globalized neoliberalism, austerity politics, small government, Reaganomics, and Thatcherite Utopian laissez-faire capitalism are dead. The world will be reorganized over the next few years, and the end result will certainly be a vastly increased role for governments in the economy and in financial markets.

This is not merely my opinion, it is reflected in the actions of the Federal Reserve and in the political proposals put forth by both Republicans and Democrats this month in response to this unprecedented crisis.

The speed and scope of the March 2020 Crash was unprecedented, and so was the response of the Federal Reserve, which rushed to protect and reimburse the usual suspects.

The Fed initiated a series of emergency measures beginning last fall. In an unprecedented unscheduled Sunday meeting, Fed officials lowered interest rates to a range of 0-.25%. Markets took this as a sign of panic, and understood that the Fed could not continue to lower interest rates without entering negative interest rate territory, which Japan had been in for decades and Europe for years, to the detriment of their economies. A vertical stock market decline followed on Monday.

Since then the Fed has resurrected a variety of programs that were created during the 2008 Global Financial Crisis to bail out banks and Wall Street firms, offering trillions of dollars of essentially free money to financial institutions once again. These moves have not prevented further large declines in the stock market.

President Donald J. Trump announced the nomination of Jerome Powell to be Chairman of the Board of Governors of the Federal Reserve System / November 2, 2017 (Official White House Photo by Andrea Hanks)

The White House from Washington, DC / Public domain

On March 23, Federal Reserve Chairman Jerome Powell announced it would backstop all credit markets in the United States, without limitation! This is historically unprecedented. In addition the Fed announced in March that it was suspending reserve requirements for thousands of banks, including banks that have made trillions of dollars worth of risky bets in derivative markets -- the same type of bets that caused the Global Financial Crisis of 2008 and The Great Recession.

Banks historically have been required to keep a certain percentage of their loans and investments in cash on reserve, in case some of those investments lost some or all of their value. When the Fed perceived that banks were engaged in risky business, they would be required to add to their reserves so as to avoid the possibility of bankruptcy. But that is all so Twentieth Century. Since deregulation of banks in 2000 under Bill Clinton, such precautions are no longer taken seriously.

Wall Street financiers have repeatedly assured us that banks are well capitalized and there is no systemic risk, so onerous reserve requirements are not as necessary as once imagined.

Early in March Goldman Sachs told 1,500 corporations that there was no systemic risk, despite a plunging stock market and strange glitches in debt markets. That was obviously false.

Risk in 2020 is many times the risk bankers faced during the 2008 Financial Crisis. The international market for financial derivatives is now $1.5 quadrillion. A quadrillion is 1000 trillion dollars, and a trillion dollars is one thousand billion dollars.

In 2018, the Global Gross Domestic Product (GDP), the sum total of all economic activity, amounted to $84.93 trillion dollars. Today's derivatives casino, where investors and bankers place bets that are not revealed on stock exchanges or reported publicly in any way, amounted to 17.66 times the entire Global GDP. That sounds like a great deal of risk to me, no matter what Goldman Sachs says.

Possibly the Federal Reserve eliminated reserve requirements for banks so they would be able to use that reserve money to backstop existing bets in derivative markets, risky corporate loans, and other bank assets.

In addition, eliminating the reserve requirements frees the banks to create limitless new loans without having any money on hand in case something should go wrong. Perhaps the banks need to create limitless new loans to make new bets in the hope of covering their losses from previous bad bets.

Casino at the Atlantis Casino Resort Spa in Reno Nevada.

Jim G from Silicon Valley, CA, USA / CC BY (https://creativecommons.org/licenses/by/2.0)

This unprecedented action by the Fed certainly does nothing to restore confidence in financial markets and banks. When I first heard of it, as a former financial reporter with 30 years experience, my first reaction was to panic. The largest financial skyscrapers in town are on fire, and the firemen have decided to divert all available water in the city to fight the blaze.

On March 16, around the time of the Fed's startling action, I thought back to what happened to Citibank in 2008. Citibank stock went down about 15.14% in September 2008, the month the Global Financial Crisis exploded into public view.

Despite Citibank's obvious weakness, the Fed allowed Citibank to continue trading in derivatives at that time, and by mid 2009, Citibank was trading as a penny stock. So not a good result for hands-off regulation by the Federal Reserve.

The final report from the Congressional Oversight Panel found that between TARP, the FDIC, and the Federal Reserve, Citigroup received the most federal funding during the financial crisis for a total of $476.2 billion in cash and guarantees.

The Fed has continued to allow Citibank virtually unlimited latitude to trade in exotic derivatives that are basically opaque to regulators, investors and the public at large.

"As of September 30, 2019, according to the latest data available from the Office of the Comptroller of the Currency, Citigroup’s federally insured bank has $49 trillion notional (face amount) in derivatives, which is $16.8 trillion more than when it blew itself up in the last quarter of 2008," as reported by Pam and Russ Martens on their blog Wall Street on Parade.

Citibank branch in Chinatown district of Lower Manhattan

The original uploader was Uris at English Wikipedia. / CC BY-SA (http://creativecommons.org/licenses/by-sa/3.0/)

A dozen trillion here, fifty trillion there, multiplied by the number of big banks and Wall Street firms, and pretty soon you're talking real money. You may have to stretch your mind and start thinking in terms of quadrillions. It's tough being a central banker, yeh?

So the Fed decided in course of its March calculations that it would be best to make sure that these big banks have ZERO dollars on the line when they make these big basically unregulated, highly risky bets in black box markets. Taxpayers would be asked to socialize their losses and as usual banks would privatize all the profits they would make after any required multi-trillion dollar bailouts, after all.

The March 2020 Global Financial Crisis is so acute that on March 23 the Fed announced that for the first time in history it would buy troubled corporate bonds. That's because the market for BBB rated corporate debt, which is just barely more credible than junk bonds, exploded in size over the last two decades, from $2 trillion in 2001 to $10 trillion in 2019. This type of debt pays high interest rates compared to regular government bonds, which have had poor returns in an era ultra-low interest rates.

The bulk of this debt is issued by the holding companies of big banks like Citibank, telecommunications companies, utilities, and petroleum companies that engage in fracking, a notoriously risky activity.

The problem with this debt is that in the event of a recession or God forbid a depression like what we potentially face today, that debt will be declared speculative, and interest rates on that debt will skyrocket, bankrupting the debtor companies. That would potentially bankrupt many banks, telecommunications companies, airlines, hotels, and petroleum producers.

This may be why President Trump has openly discussed bailouts for companies in several of these sectors. And could be another reason the Fed decided to eliminate reserve requirements for banks. Perhaps they would have lost a lot of those reserves when the BBB rated debt they are holding imploded. Not to mention the losses they would incur when the interest payments on their own BBB rated debt increased astronomically.

But hey the Federal Reserve will be paying taxpayer cash for trash, so no problem.

The Fed also plans to purchase a wide variety of other troubled financial instruments in various arcane markets, but we have neither time nor space to go into more detail. I think you get the idea.

A "We Are The 99%" poster created by an Occupy Wall Street group.

Seth Cochran / CC0, September 17, 2011

Corporate socialism is back with a vengeance. Bailouts of the 1% are ongoing. The sums are astronomical.

Half of American households have less than $400 in reserve. In May 2019, with a 3.6% unemployment rate, 5.9 million people were counted as unemployed, but that did not include another 3% or so who had failed for some time to find work and were counted as "discouraged workers" or those only "marginally attached" to the job market.

What will happen when 20-30% unemployment leaves 30 million American unemployed with no savings to fall back upon? How long will it be before they descend on shopping malls and Wal-Marts with their millions of legal handguns and long rifles to seize the food and supplies they need? Will they defend their homes by force from foreclosure or eviction? These are questions that Congress and President Trump should be asking themselves. We may find out the answers to thes

e questions later this year. I pray not.

In order to avoid a crippling Depression that would make the Great Depression of the 1930s look like a mild recession, it is necessary to bring the coronavirus under control, using the types of measures that were effective in China, Taiwan and South Korea, and by rapid development of mass testing capabilities, new treatments and a new vaccine.

But that will not be enough to insure public safety in the short term. This is a very difficult epidemiological struggle, and a long term one, sure to take a year or two. In the meantime, hopefully cases will be reduced during the summer, but can be expected to spike again next flu season. Perhaps the cycle will repeat next year, with various spots around the world becoming hot spots, then seeing reduced numbers of cases.

This will continue to disrupt the economies of leading economic powers such as China, Europe and the United States. These disruptions will force millions of small businesses, and thousands of large businesses into bankruptcy. Many more will downsize, and uncertainty will make employers reluctant to reopen their businesses and/or rehire downsized employees over the next year or two.

Financial markets around the world will not be satisfied unless governments guarantee the loans of all important corporations, buy stocks directly for the first time in history to put a floor on stock prices, provide bailouts of the corporations in the most blighted sectors of the economy, purchase the bad debt of those corporations, making investors whole, and somehow prop up the purchasing power of the general population.

That will not be enough to avoid a painful replay of the aftermath of the 2008 Global Financial Crisis, which ushered in a decade of austerity for the vast majority of Americans. Except this time, the crushing impact of bringing the economy to a full stop will dwarf the effects of the residential real estate crash.

Consumer spending comprises 70% of Gross Domestic Product, so if 30% of the public is unemployed by this fall, as Wall Street and the Trump administration expect, financial markets will crash again and again. This rolling bear market will be punctuated with random upward spikes as investors react favorably to various bailouts and new efforts to stimulate consumer spending.

But the underlying dynamic will remain the same. The global supply chain cannot be reconfigured in favor of domestic production for years, even if that goal becomes national policy in developed economies around the world. Fiscal stimulus designed to encourage consumer spending by reduced payroll taxes, increased sick leave, occasional direct payments, or free virus testing will certainly be insufficient.

It is now a given that there will be a massive turning away from the limited government and free market economics of the neoliberal post-Reagan era around the world. Big government is here to stay. Government bailouts several orders of magnitude greater than anything seen before in America are already in the pipeline for banks, Wall Street, investors, and large corporations.

On the economic front, the question is simple. Will the big government programs designed to fight the impending Great Depression of the 21st Century be designed as corporate socialism, in the spirit of the 2008 Bailouts, or will there be a more egalitarian form of socialism?

From an economic viewpoint, the only way to stimulate an economy dependent on consumer spending where unprecedented numbers of people suddenly have no money is to provide a robust government safety net and programs designed to provide new jobs in new sectors by government fiat.

This could mean among other things: universal government sponsored free health care, increases in the minimum wage, expanded sick days for all workers, maternal and paternal leave and other basic employment rights for workers, a Green New Deal that in one way or another creates millions of new jobs in renewable energy, retro-fitting of aging infrastructure for Green 21st century use, small scale urban and rural organic farming projects, and other post fossil fuel industries, taxation of billionaires to help fund these programs, and federal government revenue sharing with American states, which will see their income from sales taxes and property taxes plummet, forcing many to the brink of bankruptcy. Mega corporations should no longer be allowed to evade income taxes as Apple, Amazon and so many others have done for so long. Corporations receiving bailouts should be considered wards of the state, and workers in those companies should be given power sharing agreements that will give them power to decide how these companies are run.

The nationalization of the banking industry and of Wall Street investment firms that have already cost US taxpayers dozens of trillions of dollars in the last decade or so should also be on the agenda. These industries should be reconfigured to help provide much needed money for the radical redistributionist policies mentioned above.

There is a danger that either populist Republican or neoliberal Democratic politicians will want to simply print money to pay for fiscal stimulus on the order of trillions of dollars over the next few years, but that could lead to bouts of fast-rising inflation that would smother any infant recovery in its crib.

Just because governments with their own currency can print all the money they want doesn't mean that financial markets and other countries around the world will continue to accept that money at face value. That is strictly a matter of confidence. If that confidence evaporates, so will the value of the money.

That is an especially important point for the United States, since the dollar is the de facto global currency, and underpins American claims to global hegemony.

Right now, it is difficult to imagine an enlightened American leadership class that can implement an effective response to the coronavirus pandemic, perform extremely expensive financial surgery on our banks and investment firms while instituting a monetary regime that incorporates much more financial democracy into the system, enact corporate bailouts on an unprecedented scale while demanding fair and equitable give-backs from the corporations receiving taxpayer largesse, and simultaneously enact Congressional fiscal stimulus packages that would leapfrog the country past the fossil fuel economy of the 20th century and jumpstart a renewable and sustainable 21st century economy that benefits the vast majority of the population and not just the elites and large corporations.

We need that enlightened leadership to emerge in the next few years because otherwise America will be mired in an ongoing Greater Depression which will see this country lose its favored position as global hegemon, and also most likely foment civil discord that could tear the country apart.

As of today, Wednesday March 25, the Senate and the President have agreed on a multi-trillion dollar stimulus package to revive the economy. The House of Representatives will have to also pass the bill, so it is impossible to know with certainty what its final form may be. We will analyze that in a future newsletter, but for now the general outline is clear. The bill is heavy on corporate socialism and contains various small virtue-signaling hand outs to the general populace, which will not be sufficient in this emergency.

"An emergency stimulus package to bailout the U.S. economy amid the coronavirus pandemic will total $6 trillion — a quarter of the entire country’s GDP, the White House said Tuesday," as reported in The New York Post. "Trump administration economist Larry Kudlow said the package would include $4 trillion in lending power for the Federal Reserve as well as a $2 trillion aid package currently being hammered out by Congress. 'This package will be the single largest main street assistance program in the history of the United States,' Kudlow said at the White House coronavirus task force briefing on Tuesday evening."

"Included in the package is Congress’ almost $2 trillion emergency bill which, when passed, will issue direct checks for American families, bailouts for the airline industry and a $350 billion loan program for struggling small businesses. The other $4 trillion will allow the Federal Reserve to make huge emergency bailouts to whatever entity it chooses — a measure that was used to prop-up Wall Street firms from collapse during the 2008 financial crisis. 'This legislation is urgently needed to bolster the economy,' Kudlow added, warning the economy had tough times ahead. 'We’re heading for a rough period but it’s only going to last for weeks, we think. Weeks and months. It’s not going to be years, that’s for sure,' he said, echoing comments from President Trump that the economy will bounce back to its pre-pandemic high."

For reasons outlined above it's impossible to believe these assurances that the "rough period" will only last a few weeks. The elite consensus is that everyone will go back to work very very soon so there's no need to provide assistance to the 20-30% of American workers about to lose their jobs over the long term, and no need to worry about their health when they return to work in the immediate future. There's also no provision for free coronavirus treatment. You need a doctor's note to get tested. There is no provision to make up for lost wages now or in the future. The $1200 checks will not be for everyone. So we can tell already that this is not a serious effort to deal with the crisis, but rather a bold attempt at evasion, merely kicking the can down the road until the next acute phase of the crisis unfolds.

Nouriel Roubini, Professor of Economics and International Business, Leonard N. Stern School of Business, New York University, USA; Global Agenda Council on Fiscal Crises is seen during the session 'Fixing Capitalism' at the Annual Meeting 2012 of the World Economic Forum at the congress centre in Davos, Switzerland

World Economic Forum / CC BY-SA (https://creativecommons.org/licenses/by-sa/2.0)

"In any case, even if the pandemic and the economic fallout were brought under control, the global economy could still be subject to a number of white swan tail risks," contends famous economic forecaster Dr. Nouriel Roubini. "With the US presidential election approaching, the Covid-19 crisis will give way to renewed conflicts between the West and at least four revisionist powers: China, Russia, Iran, and North Korea, all of which are already using asymmetric cyberwarfare to undermine the US from within. The inevitable cyber attacks on the US election process may lead to a contested final result, with charges of rigging and the possibility of outright violence and civil disorder."

"Similarly, as I have argued previously, markets are vastly underestimating the risk of a war between the US and Iran this year; the deterioration of Sino-American relations is accelerating as each side blames the other for the scale of the Covid-19 pandemic. The current crisis is likely to accelerate the ongoing balkanization and unraveling of the global economy in the months and years ahead," Roubini explains.

"This trifecta of risks – uncontained pandemics, insufficient economic-policy arsenals, and geopolitical white swans – will be enough to tip the global economy into persistent depression and a runaway financial-market meltdown. After the 2008 crash, a forceful (though delayed) response pulled the global economy back from the abyss. We may not be so lucky this time," Roubini concludes.

This March 2020 Global Financial Meltdown clearly represents the beginning stages of the upheaval astrologers have predicted for America's Pluto Return.

Image Credit: NASA, JHU APL, SwRI, Alex Parker

The transit of Pluto in Capricorn represents a trip into the underworld for the United States in particular, and for the world in general. Humanity has been sent on a hero's journey into the realm of Pluto, or Hades, who presides over the realm of the dead, and whose specialty is the total transformation of individuals and social structures at the molecular level. In that process whatever has been repressed comes to the surface, often violently, as part of the archetype of death and resurrection the heroic journey symbolizes.

This transit into the hell realms began with the square of Uranus in Aries to Capricorn in Pluto, which persisted off and on from 2007 through 2020. Saturn's entry into Capricorn in 2018 marked the beginning of a new Saturn-Pluto cycle, a prelude to the Capricorn Stellium of January 2020 and America's Pluto return, coming in 2021-2023, when Pluto will return to the position it inhabited at the birth of our country. Astrologers see the Pluto return as a time when Empires collapse, and the political systems of nations undergo forced revolutionary change.

Worst case scenarios include a descent into civil war and authoritarian clampdown by the national government, a breakup of the nation into bickering smaller state entities, and a sudden end to America's role as leader of the global financial and political system that was created by American leaders in the aftermath of their victory in World War II.

Best case scenarios would include a forced purging of outdated and toxic political and financial arrangements -- a true draining of the swamp that would see financial, political and corporate elites removed from positions of power. In such a case social democracy would replace today's corporate socialism, a Green Revolution would replace our outmoded and deadly fossil fuel economy, and a new, more egalitarian ethos would replace today's Darwinian winner-takes-all social consensus.

So what does this all mean for our economy and financial markets going forward from today's Global Financial Crisis 2.0?

"In studies published in The Ultimate Book on Stock Market Timing, Volume 2: Geocosmic Correlations to Investment Cycles, by Raymond Merriman, it was illustrated how the bottom of the longest cycles in British and U.S. stock markets occurred during the times Saturn and Pluto were in cardinal signs, and Uranus was posited between 22º Pisces and 23º Aries," according to Raymond Merriman's March 23, 2020 blogpost on financial astrology. "These studies also showed that a secondary bottom occurred a few years later, usually 6-15 years later, when Uranus moved into Taurus. The long-term Great Depression/Recession cycle lows of 1842, 1932, and 2009-2010 had many of these characteristics. For instance, the Great Depression saw the stock market suffer a huge 90% sell off in U.S. stocks starting in 1929, that bottomed in July 1932, after Saturn had just entered Aquarius, following it passage through Capricorn the prior 2-½ years, during the same time Pluto was in Cancer and Uranus was in Aries. Secondary lows happened in 1938 and 1942, after Uranus had ingressed into its next sign of Taurus. The Great Recession stock market low of March 2009 occurred shortly after Pluto’s entrance into Capricorn, and while Saturn was in opposition to Uranus in late Virgo/Pisces, just before each ingressed into cardinal signs (Uranus was in its usual sector of 22º Pisces and 23º Aries, but Saturn was not yet into cardinal Libra until later that year)."

Suffice it to say that Saturn and Pluto are both in Capricorn, a cardinal sign, and Uranus is in Taurus, indicating that we now have astrological parallels with the onset and the deepest lows of historical financial crashes. Saturn entered Aquarius a few days ago, but will go retrograde into Capricorn again in a few months, and will re-enter Aquarius for the final time at the end of the year. Merriman's work indicates that Saturn in Aquarius could usher in a period of 2.5-3 years in which the bear market and the Great Depression 2.0 actually deepen.

"Now for the optimistic view on where world stock markets might be," Merriman continues. "Saturn and Pluto are once again in cardinal signs, this time with both in Capricorn. Uranus has now moved fully into Taurus. These are the historical placements for a secondary bottom to the long-term stock market cycle. The crash associated with Saturn and Pluto in cardinal signs is now underway. But, as in July 1932, could they end when Saturn enters early Aquarius? Could it be a secondary low as it was in 1938 and 1942 when Uranus was in Taurus? If so, this panic could end soon. Saturn will ingress briefly into Aquarius starting this weekend, March 21-July 1, 2020, just as it did February 24-August 13, 1932. The current case will also see Saturn returning for a short journey back into Capricorn, July 1-December 17, 2020 (just as it did in 1932), all during the time that Pluto is still in Capricorn and Uranus in Taurus. The parallels between the 1929 and 1942 have many common features to the planetary positions and relationships to one another today. If it is to be like 1932, the absolute bottom to this stock market collapse could be over by July, as Saturn has its brief preview of life in Aquarius. If it is more like 1942 (secondary bottom), it could extend into December 2020-March 2023 when Saturn returns to Aquarius with Uranus still in Taurus, and especially December 2020-March 2021, when Saturn is in the first decanate of Aquarius."

So if we are lucky the worst could be over this summer, but since we know that the virus cannot be contained in the space of a few months, that seems very unlikely. After pondering the geopolitical and economic problems enumerated by Dr. Nouriel Roubini, I would not want to place any big bets on a rapid recovery. More than likely we are in for several years of hard slogging, a prelude to revolutionary changes of one kind or another.

To be continued. . .

Jane and I send you all Love and Light this New Moon week. May you be healthy and safe during this global crisis. May you all receive the grace and guidance you need to navigate the troubled waters we traverse today.

Curtis and Jane in downtown Winston-Salem's Art District

Meditation Moment: LOVERS FIND SECRET PLACES

Lovers find secret places

inside this violent world

where they make transactions

with beauty.

Reason says, Nonsense.

I have walked and measured the walls here.

There are no places like that.

Love says, There are.

— Rumi, from "Secret Places," Bridge to the Soul: Journeys Into the

Music and Silence of the Heart - as rendered by Coleman Barks